If you have your finance systems in place, you’ll never be surprised when a financial crisis hits. You’ll be able to see it coming from afar. So that you may even be able to avoid the worst coming to the worst. But just in case you’re hit by a financial crisis, here are my 3 tips for handling money in a financial crisis situation.

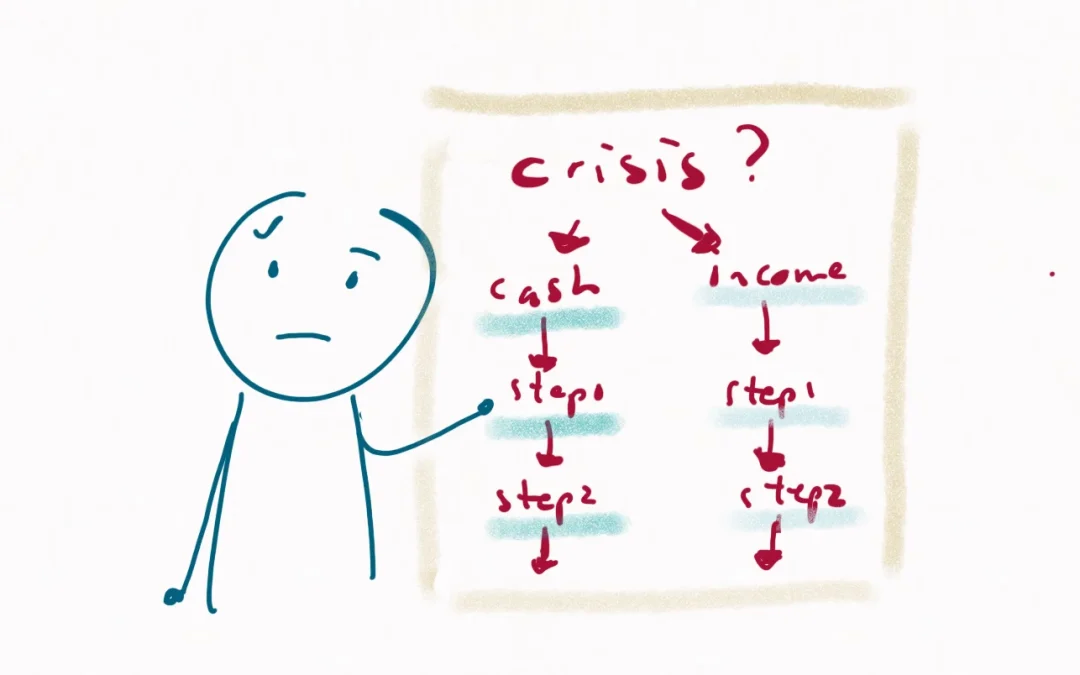

What’s the crisis?

First of all, you need to identify the type of crisis. Is it a matter of not having enough money in the bank when you need it? This could be the result of your donor’s practice of letting you pre-finance some project costs. Or is it a matter of not having secured enough income from donations, sponsorships or grants?

Cash flow crisis

If you face a cash flow crisis, you have enough income secured. But the timing of the income does not match your needs. So you don’t have the money when you need to make a payment. This happens a lot if you have project grants. Very often, donors will pay the final 10 to 20% of the total amount only after they approve your final report. So you need to pre-finance these expenses, report on them, and then wait maybe three months before the donor reimburses you.

What to do?

A cash flow projection helps you see when a cash flow crisis could appear. This gives you time to identify:

- Payments you can delay.

- Incoming amounts you can speed up.

Incoming amounts could be donor instalments that you can request sooner if you send your report in time. But it could be that you could share your donation link more actively and get more donations that way.

Tip 1

My crisis tip if your crisis is a cash flow crisis: spend more energy on speeding up incoming amounts than on delaying outgoing amounts.

Avoiding a cash flow crisis

It can be a challenge to avoid a cash flow crisis altogether. But with a cash flow projection (that you keep up to date!) you can definitely minimise it and make it more manageable. Another thing you can do is include in your financial policy rules about accepting project grants with pre-financing. You could for instance make it a habit to discuss this issue with the donor. Or you could set limits to how many such grants you can have at the same time. Or you could see if you can space out grants with pre-financing so that they’re not all having the same pre-financing rhythm.

Income crisis

An income crisis is when you don’t have enough donor commitments to cover all the costs you’re incurring. You may have money in the bank. But that money may be earmarked for a certain type of project expenses or for a specific period. So you can spend this money now on other things. But those things will not be recoverable from the grant. This happens a lot if you don’t have a system for including general costs in your budgets for project grant applications or sponsorships. Or if you decide to organise activities without having funding. For instance in case of an emergency situation in the community you serve.

What to do

In an income crisis, you can decrease uncovered costs or increase coverage of costs. Meaning you can terminate contracts with suppliers or staff. Or decide not to organise activities for which you have no coverage. This requires insight into the costs that are not covered and the terms and conditions for decreasing or stopping them. For instance, your suppliers may have Terms & Conditions that say that you can terminate with two-months’ notice.

Tip 2a

Create insight into what’s not covered and what are applicable terms & conditions to terminate or avoid these costs. Also, bear in mind the cost of terminating or not doing. What if you lose the goodwill or expertise you need later on?

Tip 2b

Now that you have insight into what’s not covered and why these costs are needed – go talk to your donors. See if they can be creative with you and find a way to cover these costs within ongoing grants or sponsorships.

Tip 3

Be open to a need to invest money to generate income. For instance, you may want to visit your donor abroad in person. Or you may want to invest in a marketing campaign. Or in something else. Sometimes cutting all costs is counter-productive as it harms your chances of generating the income you need.

Avoiding an income crisis

Income crises are very common, unfortunately. Just like cash flow crises. There are a few things you can do to avoid them or mitigate their impact on your organisation. You can

- Build up reserves. That way, you’ll have money to cover necessary costs if there’s no donor coverage. The board needs to approve the use of reserves.

- Make a proper calculation of all general costs that you need to make all the project work possible. Then use this information to calculate a reasonable fee for time spent, that includes an allocation of these general costs.

- Define a policy for applying for or accepting donor grants or sponsorships. So that you know your general costs are covered via a fee or a % of admin costs that’s reasonable.

- Invest time in learning from budgeting mistakes. (Or learn proper project budgeting in my course Project Proposal Design for Nonprofits).

- Develop a fundraising policy that includes generation of unearmarked income, that you can use whenever you need it for everything you need it for.

- Create a good management report overview for keeping track of income and your overall needed budget, with special attention for general costs. Make it a habit to monitor this monthly.

Summary

It may not be possible to avoid a cash flow or income crisis altogether. But it definitely is possible to minimise the impact of such a crisis. Investing time in being in control of your finances and in having proper policies helps. It’s also helpful to invest in a good fundraising strategy and plan, with multiple sources of income. And it will definitely pay off if you invest in building solid relations with your donors so they will be your ally in hard times.

In case you’re not able to avoid a crisis, my 3 tips for handling money in a financial crisis situation can help guide your actions.

How I can help

If you would like simple steps to set up and organise your finance & admin foundations guidance by me, you can get my bundle of six simple and short workshops.

- This bundle includes a workshop about cash flow projection and a workshop about fee calculation that could also be purchased separately via the bundle page.

Watch my video 3 tips for handling money in a financial crisis in your nonprofit. You can also check out my YouTube channel here, and find a collection of videos on HR issues, fundraising, annual reporting, donations and other nonprofit operations topics.

Want to know more and ask questions?

If you want to discuss this more – jump into my nonprofit support community and get input from a wide range of peers and from myself!

Here is how you can join my free nonprofit support community

You can join my free nonprofit support community on the Heartbeat platform here. This group is a safe space for open exchange and discussion on potentially sensitive topics like boards, nonprofit management, fundraising, etc. You can visit the community via a browser or via an app. Here is the link to download the Heartbeat chat app in the Google Play store.

Want to support me with a cup of coffee?

The seaside always inspires me and helps me think of articles, videos, workshops and courses I can create for you. If you want to support me without getting a paid workshop, course or review – you can donate me a coffee and speed up my thinking process! You can support me here: https://ko-fi.com/suzannebakker