If you buy equipment that costs more than a certain amount, this equipment becomes a so-called tangible fixed asset on the balance sheet of your annual accounts report. Maybe you wonder what that means and why it might be important?

Equipment on your balance sheet

The balance sheet of your annual accounts report includes your organization’s assets, liabilities and reserves. Equipment, furniture, cars, etc. are all assets. (They are tangible fixed assets as opposed to intangible fixed assets – like software or a website – or liquid assets – money on the bank and in cash). These are items that you will use for a period of more than one year. Because of that, you depreciate them annually. That is, you do not take the full purchase amount as a cost in the year of purchase. Instead, the cost presented is an amount that reflects the share of costs of the total lifetime of the item in the year. That way, each year only carries the share of the purchase costs that is applicable.

For example

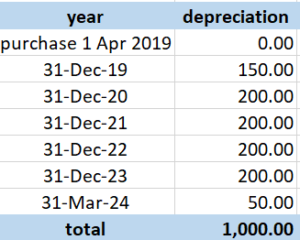

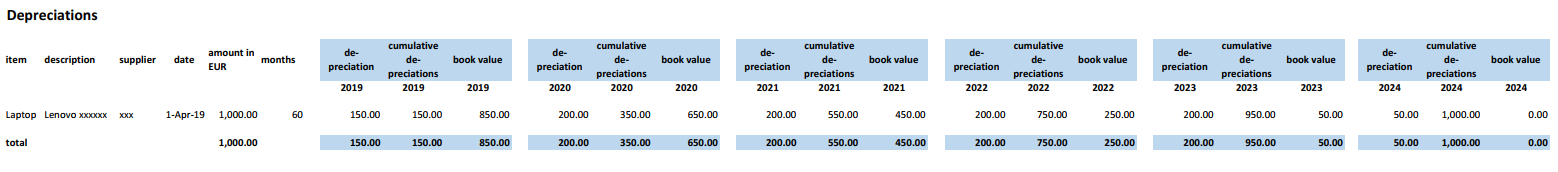

You buy a laptop of EUR 1,000. The depreciation period is five years.

This means that for each twelve months, the life cost of the laptop is EUR 200 (as 5 x EUR 200 = EUR 1,000). This is the annual depreciation amount. If you buy this laptop on 1 January, the cost for the calendar year is EUR 200. If you buy it on 1 April, the cost in the calendar year is EUR 150 (9 months / 12 months x EUR 200). If you buy it on 1 June, the cost in the calendar year is EUR 100. And so on.

Depreciation calculations

The laptop is depreciated in five years. So if you had bought a laptop on 1 April 2019, it is fully depreciated as of 31 March 2024.

During this period, the laptop costs presented in the Statement of Income and Expenditures are the depreciation amounts as above. As you see, depreciation lowers annual costs of equipment, by spreading out the total costs over the lifetime span of the item. You do not have EUR 1,000 as a cost, but maximum EUR 200.

Balance sheet calculations

However, you did spend EUR 1,000. And you do have a laptop that you might sell, if the worst comes to the worst. You have something of value in your organization. That value is not presented fairly with only EUR 200 under Expenditures.

Activating the asset

So how can you include not only the annual expenses for the item but also its real value in your annual accounts report?

For this, you activate the laptop. (Sorry for this term, I did not invent it! Does it also give you images of a computer uprising?). This term indicates that you process the equipment as a balance sheet item, not as an expense. The expense you record is depreciation, not the purchased laptop itself.

- You book the laptop in full on a balance account for purchase computer equipment. (This is often account 0100 or thereabouts).

- Every year you calculate the depreciation amount for the year. You use a journal booking to credit this amount to a balance account for depreciation of computer equipment. (This is usually an account one number lower than the purchase account, so for instance account 0101). The debit of this booking goes to an expense account for depreciation of computer assets. (In your expense account series not related to projects, which mostly start with 4, so for instance 4200).

- Now the total of the purchase account and the depreciation account for equipment reflects the remaining book value of the laptop (which will be zero by 1 April 2024).

- The expense account for depreciation of computer assets reflects the change in book value.

See below how this looks through the years.

Annual accounts report

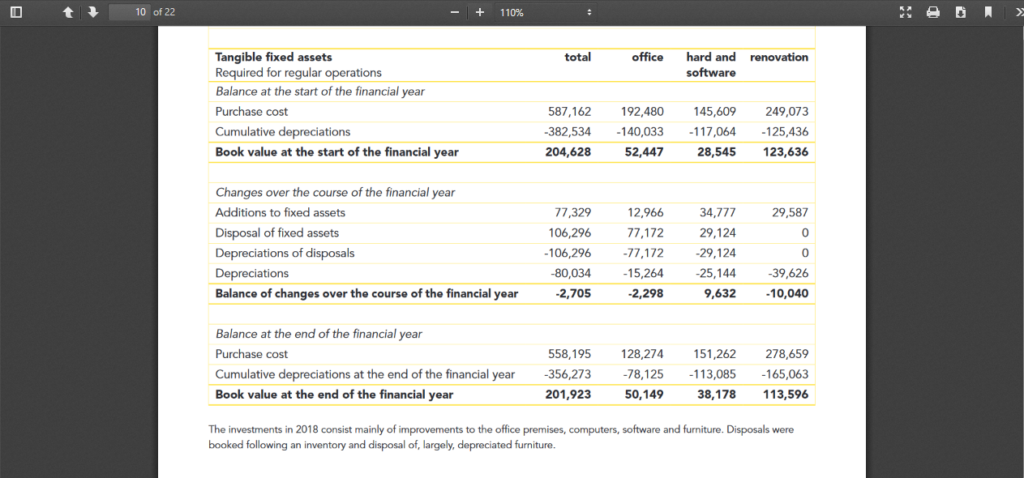

In your annual accounts report, you present an overview of total purchase costs, cumulative depreciation and remaining book value of your tangible fixed assets.

See below for an example from the annual financial report of Free Press Unlimited, 2018, which you can find here via a public link.

The relevant number on the balance sheet is the book value of your purchases. This value is seen as potential capital for your organization, an asset. If needed, you could liquidate your assets to raise cash for your organization.

But what about ….

So now you know what to present and how to make the calculations. But three questions remain:

- How do you decide what the threshold amount is to activate and depreciate your laptop, furniture, car, or other equipment?

- Who decides on a proper period for depreciation?

- How to handle purchase of such equipment under a grant?

Threshold amount

The threshold amount depends on the following:

- Legal framework, if there is legal guidance on this in your country

- Standards in your industry and/or in your country

- Your own organizational policy

Most common is to depreciate anything over a value of EUR 250 if it is an item that will last you more than a year. But as stated above, it depends on the specific circumstances that apply to your organization.

Depreciation period

The depreciation period is very often regulated by legislation in your country. Check carefully, as different standards may apply to different sectors. If you can find no legal guidance in your country for your sector, look for industry standards and decide for yourself what is a reasonable life span of the item. For laptops and computers, the depreciation period is mostly three to five years. While furniture is often considered to have a life span of ten years or even more.

In your accounting principles in your annual financial statement you disclose your approach toward activation and depreciation. This includes the depreciation percentages you apply.

Purchase of equipment under a grant

In general, it depends on the donor’s requirements or any specific arrangements you make with a funder for purchase of equipment. What the donor allows, will likely depend on the kind of purchase (is it clearly activity linked) as well as the level of development of your organization (size and age).

How I can help you

If you are looking for more guidance for your annual report and annual financial statement, these resources are for you:

- With my Checklist you can make sure your report is complete: https://www.changingtides.eu/checklistannualreport

- In case you have created an annual report and would like to hear my professional opinion, I can create a personal video review for you: https://www.changingtides.eu/reviewdonationssops

- If you would like a clear process with easy steps and guidance by me, you can join my Course Annual Reporting for nonprofits here: https://www.changingtides.eu/COURSEAnnualReporting

If you would like simple steps to set up and organise your finance & admin foundations guidance by me, you can get a bundle of six simple and short workshops here: https://www.changingtides.eu/financeandadminbundle

In case the bundle is too much for you at this moment, these are two workshops that might be relevant for you now:

- Set up your financial processes: https://www.changingtides.eu/financialprocesses

- Understand important basics of bookkeeping for nonprofits: https://www.changingtides.eu/bookkeepingfoundations

Want to know more and ask questions?

If you want to discuss this more – jump into my nonprofit support community and get input from a wide range of peers and from myself!

Here is how you can join my free nonprofit support community

You can join my free nonprofit support community on the Heartbeat platform here. This group is a safe space for open exchange and discussion on potentially sensitive topics like boards, nonprofit management, fundraising, etc.

You can visit the community via a browser or via an app. Here is the link to download the Heartbeat chat app in the Google Play store.

Want to support me with a cup of coffee?

The seaside always inspires me and helps me think of articles, videos, workshops and courses I can create for you.

If you want to support me without getting a paid workshop, course or review – you can donate me a coffee and speed up my thinking process!

You can support me here: https://ko-fi.com/suzannebakker

Am very pleased for sharing this with me

Thank you, Sunday!

Thank you so much for this information. It’s eye-opening.

Thank you, that is very nice to hear Welile!