The balance sheet of your annual accounts report includes a section called ‘reserves & funds’, if you have any organizational capital at all (negative or positive). For continuity of the organization it is needed to have reserves, even though as not-for-profit it is not easy to build reserves.

What is a fund?

A fund is a part of your organization’s capital that is earmarked for a purpose by an external party. For example, you received a donation to spend on a certain activity, but you did not yet spend all the money. The unspent part remains earmarked for the activity and this needs to be reflected in your balance sheet. You can do this by allocating it to a fund, named after the activity or purpose. Mostly you do this when you receive money for a purpose that exceeds the book year. If you would want to use the moneys for some other purpose, you would need to get approval from the party who provided them.

What is a reserve?

A reserve is a part of your organization’s capital that is earmarked for a purpose by the advisory board or executive board of the organization. It is usual to have a reserve for continuity purposes, to offset any future losses for instance. Some organizations also dedicate reserves to fixed assets. By the time new assets need to be purchased, the reserve can cover the costs. Other organizations have reserves dedicated to innovation, for instance. Or for another specific purpose that is not expected to be covered by project grant income.

The (executive or advisory) board can earmark part of the reserves. They can also later decide to change the earmark to another purpose. Decisions regarding the reserves need to be taken in a board meeting and written down in the minutes of the meeting.

How does money enter your reserves or funds?

At the bottom of your Profit & Loss statement (also called: Statement of Income and Expenditure), you calculate the result of income and expenditure. This can be a plus or minus amount, or a zero of course. You then distribute the result over your reserves and funds, according to the earmarks that apply. Through this distribution you can add money to your reserves. Or you can subtract money from the reserves this way, if you had a need (and a decision) to use this money in the book year.

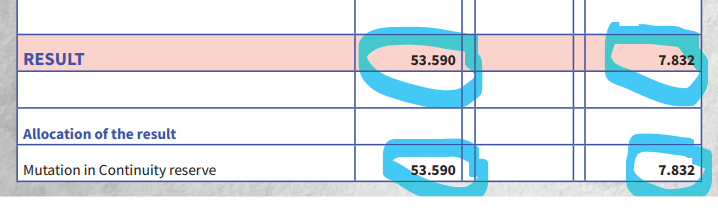

See below for an example of allocating a total result to the reserve of an organization called Young in Prison, on page 40 of their annual accounts 2018:

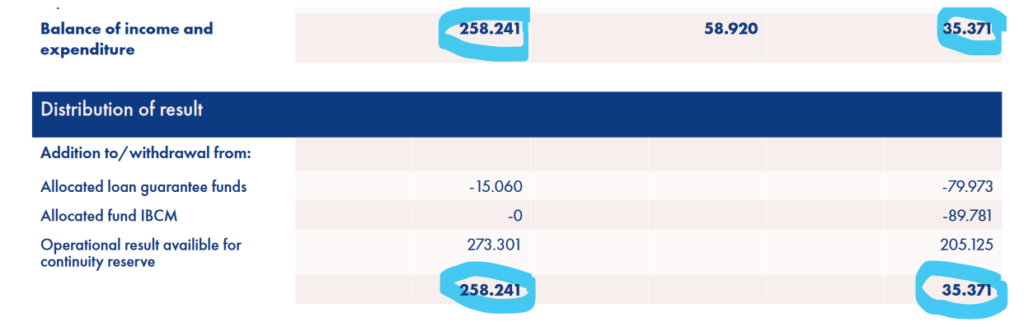

A more complex example can be seen in Sparks annual financial report 2018, on page 56. Here the result is distributed over different reserves and funds:

Continuity reserve

Most organizations have a general reserve or continuity reserve in place to make sure that the organization can meet its obligations in the future, thus ensuring its continuity. The continuity reserve can mitigate future losses or challenges, for instance covering costs if there is a gap between the end date of one project and the start date of another.

The size of your continuity reserve

The advisory board usually decides on the desired size of the continuity reserve. They do this on the basis of an analysis of the risks for the organization and the (fixed) obligations it has. The size can be limited by law, regulations or best practice in your country. In the Netherlands, for instance, the not-for-profit sector applies the rule that the continuity reserve should be maximum 150% of total annual operating costs.

Many organizations do not manage (or need) to save that much. They may have enough moneys in their reserves to cover costs during the closing of the organization and its operations in a worst-case scenario. How much that is, depends on operations and on obligations, but this might be for instance the equivalent of six months of operations.

Other reserves

Your organization may work with foreign currency contracts with a lot of fluctuation in exchange rates of the currencies involved. In that case, it can be good to set aside a reserve to cover possible future losses. Currency gains feed into the reserve, covering these future losses. This is particularly relevant if your funders do not cover exchange rate losses.

If your operations depend on expensive equipment, it might be good to put aside moneys annually to replace this equipment in future. For instance, in case you are a media house with expensive studio equipment. Or if your work depends on transport by car or motorcycle which you own. In such cases you might want to save the amount you depreciate each year. By the time the equipment is fully depreciated your reserves have reached the size of original purchase amount.

How to generate income for your reserves?

The key question is of course, how you can save money for your reserves. This money should be a positive part of your result. To put it simply, you need a profit in order to feed this into your reserves. But how can a not-for-profit generate a profit? This is a challenge for not-for-profits globally and if I could answer it here shortly and simply I would. But I cannot.

I have seen different ways of generating a surplus. Which of these works for your organization, depends very much on your set-up and your funders as well as on how your board decides to approach the matter. Below I highlight a few concrete ideas.

Donations, sponsorships, advertising and services

- Attracting non-earmarked moneys that can flow into the reserves without restrictions, where you did not make a specific promise for use of the money

- Attracting earmarked moneys for mitigating certain specific future challenges or purchases so these do not need to be covered from the general reserves

Both of these can be done through a crowdfunding campaign, a general donation campaign, a collaboration with companies or a sponsor event, for instance. For instance,Private donators might like to give money so you can purchase a studio for your work. That way, you do not need to save for that yourself from your general means.

You might also provide services or attract advertisements or sponsorships that generate income that you can spend freely. This of course depends on the applicable legal framework and your own policies and statutes that govern such activities.

Continuity reserves as part of your fee calculations

- Adding a certain amount to the fees you charge for time spent on projects financed by external donors.

You can do this only in consultation with the funders involved. This approach requires a clear policy from the organization. And a clear justification how the extra charge is calculated and what it is meant to cover. Some organizations manage to add 6% to the real costs for this purpose.

Return on investments

- Generating return on investment, for instance if you have a savings account or shares.

Obviously, interest on savings is not the best way of generating meaningful income nowadays. Return on investments of shares might yield better results, but it depends on your mission and the local possibilities whether this can work for you.

Memberships and subscriptions

- Collecting membership fees that are not (fully) earmarked to (or needed for) in-the-year expenses.

This depends on your organizational structure of course. You might also produce a newsletter that subscribers pay for, which costs less than the total subscription income for instance.

My best tip is to develop a mix of the above and other ideas you might have that work in your context. And to make sure at all times that your project income covers all your general costs properly and that you do not incur a loss on project implementation. This is a matter of decent project management and regular monitoring of general expenses as well.

How I can help you

If you would like simple steps to set up and organise your finance & admin foundations guidance by me, you can get a bundle of six simple and short workshops here: https://www.changingtides.eu/financeandadminbundle

In case the bundle is too much for you at this moment, feel free to pick one or more of the workshops individually:

- Set up your financial processes: https://www.changingtides.eu/financialprocesses

- Understand important basics of bookkeeping for nonprofits: https://www.changingtides.eu/bookkeepingfoundations

- Be sure you are keeping all the documents you need for project donors, auditors, or officials: https://www.changingtides.eu/documentationfornonprofits

- Plan your cash flow for a year: https://www.changingtides.eu/cashflowfornonprofits

- Get a feel for how time sheets can be helpful to everyone in your nonprofit and set them up straightaway: https://www.changingtides.eu/timesheetsfornonprofits

- Learn how to calculate the price of time spent of your team members, including allocations for general costs that are used in different projects: https://www.changingtides.eu/feesfornonprofits

Please note, the bundle is cheaper than buying all six workshops separately: https://www.changingtides.eu/financeandadminbundle

Here is how I can help with your annual report:

- With my Checklist you can make sure your report is complete: https://www.changingtides.eu/checklistannualreport

- If you have created an annual report and would like to hear my professional opinion, I can create a personal video review for you: https://www.changingtides.eu/annualreportreview

- If you would like a clear process with easy steps and guidance by me, you can join my Course Annual Reporting for nonprofits here: https://www.changingtides.eu/COURSEAnnualReporting

Want to know more and ask questions?

If you want to discuss this more – jump into my nonprofit support community and get input from a wide range of peers and from myself!

Here is how you can join my free nonprofit support community

You can join my free nonprofit support community on the Heartbeat platform here. This group is a safe space for open exchange and discussion on potentially sensitive topics like boards, nonprofit management, fundraising, etc.

You can visit the community via a browser or via an app. Here is the link to download the Heartbeat chat app in the Google Play store.

Want to support me with a cup of coffee?

The seaside always inspires me and helps me think of articles, videos, workshops and courses I can create for you.

If you want to support me without getting a paid workshop, course or review – you can donate me a coffee and speed up my thinking process!

You can support me here: https://ko-fi.com/suzannebakker