Are you also receiving all sorts of invoices for next year these days? I got mail from insurance companies, my newspaper subscription, office rent and whatnot. Companies asking me (or my organisation) to pay upfront for services they will provide to me in the future, next year.

Looking back at last week’s question, it is clear that these services are not yet expenses. There is no proof of delivery yet, and we cannot, frankly, be certain that there will be a delivery. Many things might prevent a delivery from happening between now and then.

Last week we looked at what is an expense, or more precisely, when does something become an expense, in accounting. Obviously, an insurance that I pay now for 2020 is not an expense now. It must not be shown as a cost in any reports about 2019.

But that does not mean that you need to put the invoice aside until 1 January 2020 or any other date when you open a new administrative year in your bookkeeping system. You need to process it now, also because your service provider will not like to wait until you open your bookkeeping 2020 to receive payment!

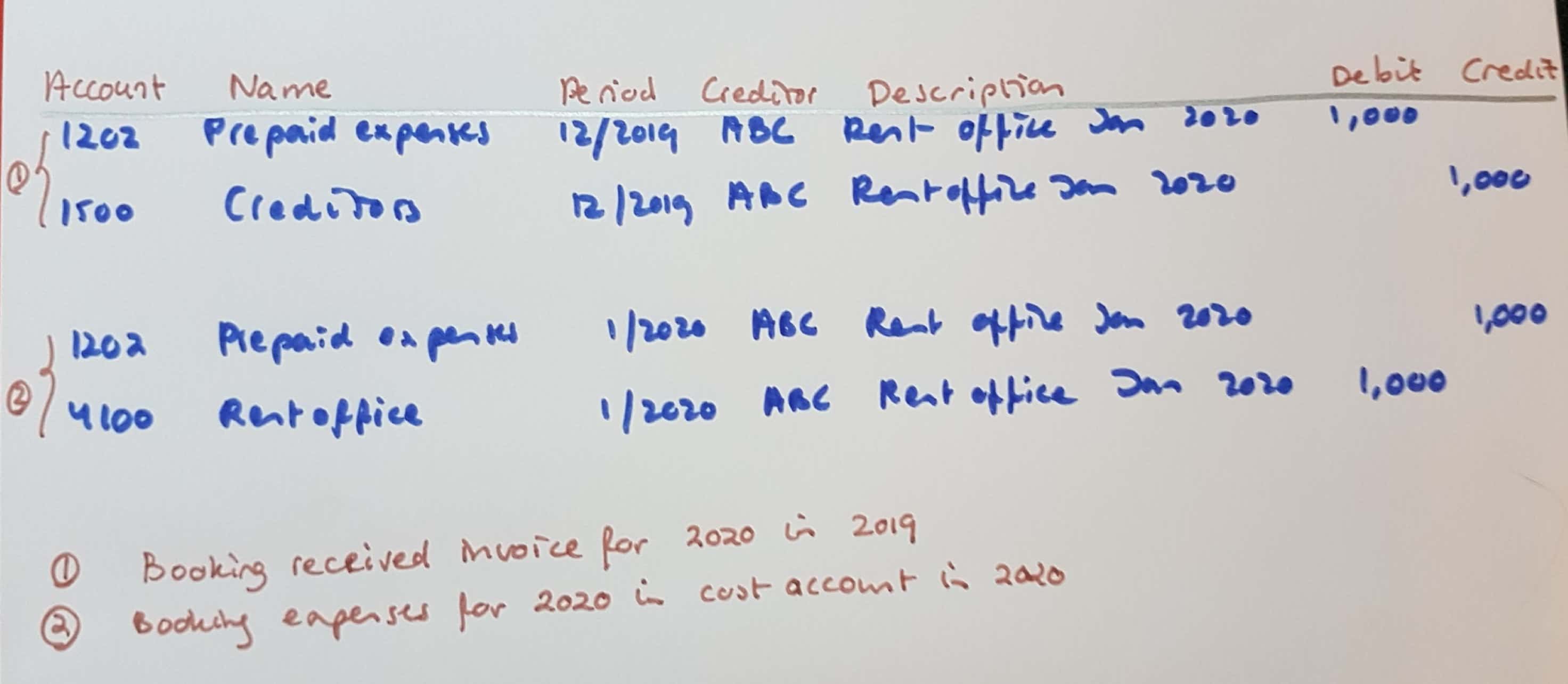

What you do in this case, is to book the invoice on the creditor (business partner or vendor, or any other name your bookkeeping uses) using a ledger for prepaid expenses on your balance sheet for the debit side of the booking (the cost side). This way, you can book the payment in the bank against the creditor in this year, 2019. The creditor position will be closed in 2019 and will not show up in your annual accounts.

The cost side of the booking, however, will show up in your annual accounts 2019. It will be on your balance sheet, as part of your assets. It is a receivable: even though you do not expect to receive money back, you do expect a service to be rendered. (If that service does not happen, you will expect money back.)

In 2020, however, these items will need to move to the relevant cost ledger (if and when it is clear they can be seen as expense). In order not to leave this until when you are going through your balance accounts as part of preparation for your annual financial statement, it is helpful to make a calendar appointment with yourself somewhere in week 3 of the new year when you can go through the prepaid ledger of 2019. Then you can make journal bookings in 2020 crediting the amounts on the prepaid ledger and debiting them on the cost ledger in 2020. There! One of the crucial year-end actions done & dusted, in week 3! (or sooner, of course if you prefer).

Accounts payable

A similar exercise applies to accounts payable: invoices you receive in 2020 while they pertain to 2019. These need to be booked as costs in 2019, but obviously the creditor position will remain open as at year-end. Receiving the invoice in 2020, you simply cannot pay this in 2019. But the expense needs to be part of any expense report on 2019.

This type of costs can be booked in several ways. You can book the expense on a cost ledger in 2019 (debit) against a creditor (vendor, business partner, or any other term you use) (credit). This way, the creditor position will be open at the end of 2019 and it will be part of the liabilities on your balance.

Alternatively, you can book the cost debit on a cost ledger and credit on a balance ledger for accounts payable. If you do this, then you should make sure to also plan a calendar appointment with yourself for some time in February to go through the accounts payable ledger in order to make sure they are all cleared in 2020 with a payment. This appointment with yourself will need to be later in the new year than the one clearing prepaid amounts, because some vendors may send you an invoice for their 2019 services as late as February 2020!

If you want to avoid issues with invoices arriving very late, you must make clear to your team that their own expense claims and any invoices of partners or vendors they work with related to 2019 must be submitted not later than date x. (I set this for the first or second Friday of the new year).

In addition, you can keep a list of regular vendors and check against this in the first week of January to see if you have received all invoices you would normally expect for December 2019.

And, last but not least you can make this part of your e-mail signature from the 1st of December onward, so that everyone you exchange e-mails with during December can be aware of this. It helps if you can make a banner, or in any other way make sure this text stands out due to size or colour of the font or the background.

How I can help

My free checklist helps you make sure your report is complete: https://www.changingtides.eu/checklistannualreport

If you would like simple steps to set up and organise your finance & admin foundations guidance by me, you can get a bundle of six simple and short workshops here: https://www.changingtides.eu/financeandadminbundle

In case the bundle is too much for you at this moment, feel free to pick one or more of the workshops individually:

- Set up your financial processes: https://www.changingtides.eu/financialprocesses

- Understand important basics of bookkeeping for nonprofits: https://www.changingtides.eu/bookkeepingfoundations

- Be sure you are keeping all the documents you need for project donors, auditors, or officials: https://www.changingtides.eu/documentationfornonprofits

- Plan your cash flow for a year: https://www.changingtides.eu/cashflowfornonprofits

- Get a feel for how time sheets can be helpful to everyone in your nonprofit and set them up straightaway: https://www.changingtides.eu/timesheetsfornonprofits

- Learn how to calculate the price of time spent of your team members, including allocations for general costs that are used in different projects: https://www.changingtides.eu/feesfornonprofits

Please note, the bundle is cheaper than buying all six workshops separately: https://www.changingtides.eu/financeandadminbundle

Want to know more and ask questions?

If you want to discuss this more – jump into my nonprofit support community and get input from a wide range of peers and from myself!

Here is how you can join my free nonprofit support community

You can join my free nonprofit support community on the Heartbeat platform here. This group is a safe space for open exchange and discussion on potentially sensitive topics like boards, nonprofit management, fundraising, etc.

You can visit the community via a browser or via an app. Here is the link to download the Heartbeat chat app in the Google Play store.

Want to support me with a cup of coffee?

The seaside always inspires me and helps me think of articles, videos, workshops and courses I can create for you.

If you want to support me without getting a paid workshop, course or review – you can donate me a coffee and speed up my thinking process!

You can support me here: https://ko-fi.com/suzannebakker

I would like to be connected with like yours and make an impact in my community.